I’ve been taking advantage of storing some spare cash in a Bankwest Qantas transaction account, which earns me 0.3 points per $100 I keep in there daily, at a max of $50,000. Every month I get a 4,562 Qantas points, which is nice, but is it worth keeping fifty grand there compared to an ETF or another investment?

First step is to work out how much a Qantas point is worth. Even an amateur points hoarder knows the value of a QFF point varies, so it really depends how you plan on using those points as to their value.

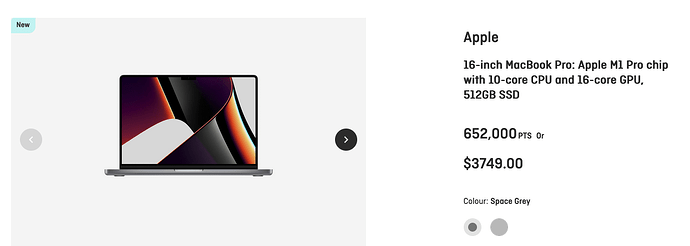

Bottom tier basic baby shit is exchanging QFF points for Woolworths gift cards. 103,450 points for a $500 gift card works out to $0.0048 per point. Not even half a cent per point. A little better is if you spend it on Apple gear, like say a 16" MBP, which is worth 652,000 points or $3,317 in a 10% off sale at JB with 3% off discounted gift cards - $0.0051 per point. Either way, the Qantas store is a waste of good points.

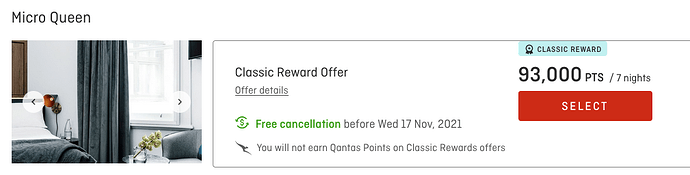

A step above burning your points at the Qantas store is using them for a hotel stay via Qantas Hotels. Using the example of a week in Sydney at the Veriu Central in late November, you can spend 93,000 points or $855 when booked via the Veriu website. Value: $0.0092 per point.

Spending points on a hotel stay is slightly better than the Qantas store, but flights are the real reason to collect QFF points. That said, the value of the points varies from flight to flight. Look at the following examples:

MEL-SYD return, economy

Classic Reward: 16,000

Cash QF: $200

$0.0125 per point

MEL-AKL return, business class

Classic Reward: 83,000

Cash QF: $2,434

$0.0293 per point

MEL-LAX return, business class

Classic Reward: 216,800

Cash QF: $11,281

$0.0522 per point

Oneworld RTW business class

Class Reward: 318,000

Cash: $13,500

$0.0424 per point

There’s also various promotions Qantas might run to redeem points in various ways that ends up being better than the values I’ve listed here and I didn’t bother adding in the fees you have to pay in cash when redeeming an rewards flight, but in general - the value of a Qantas point varies from as low as 0.48c to as much as 5.2c depending how you spend it.

Chances are I would blow my points on yet another business class around the world trip (I’ve done two, a third would be fun!), so for my circumstances each QFF point is worth 4.24c and my $50,000 in cash earns 4,562 points a month or 54,744 a year. Equivalent to $193/m or $2,316/yr - if I was to spend that money on a fancy holiday.

That’s a 4.632% pa return, risk and tax free. Pretty awesome compared to roughly 1%-1.25% I’d get in a savings account or in Plenti (which still has a bee’s dick of risk). But let’s imagine I took a little more risk and threw the $50,000 into “managed risk” ETFs designed to reduce volatility. Some scenarios, including dividends but not franking credits:

- MVOL - $8,035

- WVOL - $4,799

- WRLD - $7,948

- VMIN - $5,019

- ZYUS - $12,564

Past results are not indicative of future performance, all investments have risk, these figures don’t include the tax you’d pay on the dividends/capital gain and so on - but I think I’ll transfer that cash into my brokerage account and buy some ETFs…